PayHR Payroll

Coming Soon...

Do it yourself

Effortlessly Process Payroll with Precision

Set up your payroll with ease no external support needed. With PayHR's user-friendly interface, you can confidently handle every step on your own, guided by helpful tips along the way. Seamlessly process payroll while ensuring accurate statutory deductions as per Indian regulations.

About Us

We are a team of professionals with over 20 years of experience in payroll management and compliance across India.

Our Expertise:

-

Specialization in Indian Payroll

-

Expert in Payroll Compliance

-

Proficiency in Managing Labour Compliance

PayHR is your ultimate resource for all things payroll processing in India. Whether you're a payroll mentor, HR professional, legal manager, or payroll consultancy firm, our platform keeps you updated with the latest notifications, circulars, and amendments in payroll accounting. We also offer cutting-edge online tools tailored for payroll and HR professionals to streamline and simplify payroll management, ensuring accuracy and compliance with Indian regulations.

Why Opt for PayHR Payroll?

- Payroll processing made effortless. No more hassles in tracking and updating payroll rules. PayHR keeps you automatically updated, ensuring compliance and accuracy every time.

- Comprehensive Tools: Access tools specifically designed for payroll management and compliance tracking.

- Expert Insights: Benefit from expert articles and analysis on payroll and HR trends.

Our journey began on April 1, 2020 with tools for HR and Payrol, and with getting feedback from user for cheaper payroll software, since then PayHR Payroll was developed.

Sign-Up for trial period and enjoy the simplicity of Indian Payroll.

Services

We specialize in delivering expert solutions tailored to your specific requirements. Our services include

Payroll Management

- Complete Indian Payroll Processing

- Statutory Compliance Management(PF, ESIC, PT, LWF & Tax)

- Various Payroll and Stautory Reports

- For Payroll Services, Sign-up: www.payhr.site

Setup your account Today-DIY

- PayHR Payroll works on Do It Yourself) model

- Complete your Organisation setup

- Add your employees for onetime

- Add you past payrolls within FY

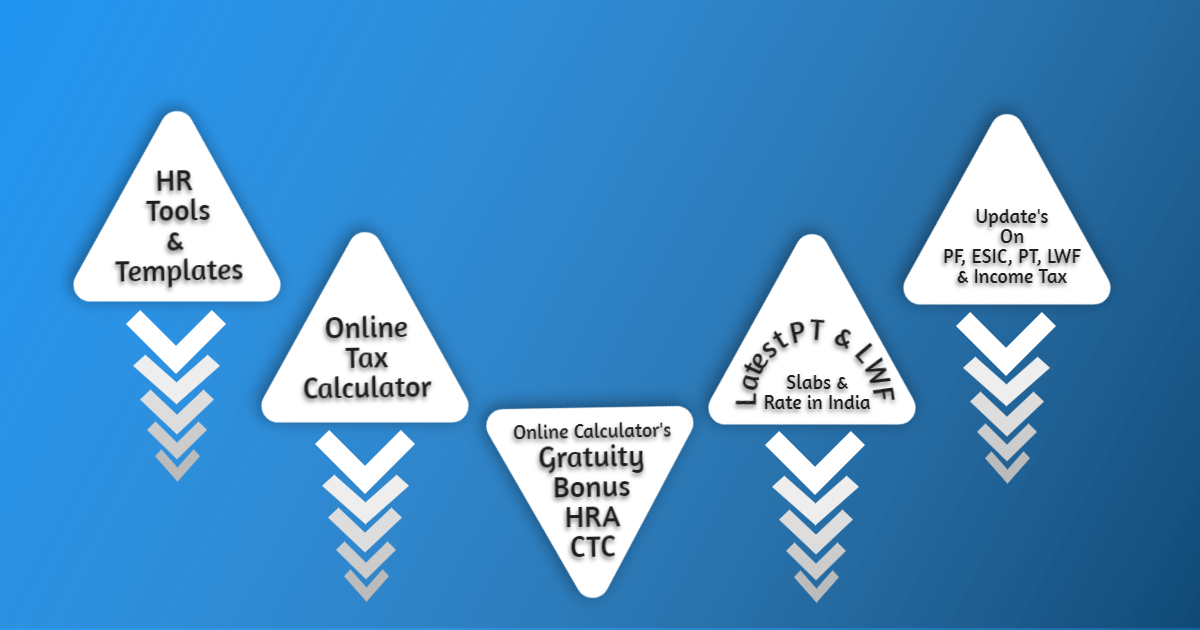

Online Tools and Resources(BLog)

- Access to the latest HR and payroll tools

- Real-time updates on payroll regulations

- Interactive CTC calculators with compliance

- Tax Calculator

HR Templates(BLog)

- Access to various HR Templates

- Download Excel and Doc files

- Templates as per latest guideline

- PayHR Blogs, its free for all

Pricing

Select the plan that best aligns with your daily activities and specific requirements. Login to buy your plan...!

Free Plan, 7 days Trial

₹0 / month

- Setup your Orgainsation -DIY

- Can add upto 10 employees only

- CTC made easy with default template

- Process payroll

- Download payroll and compliance report

Employee Plan

₹25 / per month

- Setup your Orgainsation -DIY

- Can add upto 100 employees

- CTC made easy with default template

- Process payroll

- Download payroll and compliance report

Employee Plan

₹35 / per month

- Setup your Orgainsation -DIY

- Can add upto 250 employees

- CTC made easy with default template

- Process payroll

- Download payroll and compliance report

Frequently Asked Questions

Have Questions? We Have Answers

How do I sign up for PayHR?

Go to the website payhr.in and click on the Sign-up button located at the top right-hand side. For more details on how to use PayHR, you can watch video which is availble on home page. PayHR Payroll works on Do It Yourself model.

Once I log in, will I get a demo on how to use the module?

No demo is provided. The system is designed for self-service (DIY - Do it Yourself). A help center is available on each page to assist you.

If I have any doubts, how can I reach PayHR support?

You can reach us via email at payhr.in@gmail.com. You will receive a reply within 2 working days.

Will I get a refund if I decide not to use the product?

Once the payment is made and a plan is chosen, there is no refund option available.

What services does PayHR actually provide?

If you are an HR professional, payroll person, or owner of an establishment with a startup, the main pain point is to process payroll with various statutory and tax deduction which is complicated in Indian Payroll. With PayHR this is made easy for user to run payroll month on month.

Can I customize the salary breakup in PayHR?

Yes, PayHR allows you to customize the existing salary breakup as per your organization’s requirements, ensuring flexibility and compliance with regulations. Also you have ability to add multiple CTC Template as per your organization grade structure.

Is PF, ESIC, LWF, PT and Tax deducted correctly?

Yes, PayHR compliance deduction is done based on latest amendement under various Acts.

For Professional Tax and LWF the Pan India deduction is correctly applicable.

The Income Tax computation is calculated as per latest 23rd July, Budget 2024, with latest tax rates.

Is my data secure with PayHR?

Absolutely. PayHR uses industry-standard encryption and security measures to ensure that your data is protected at all times. PayHR is not capturing or asking any information related to employees like PAN and Aadhar. But if your wish to keep track on this then it upto your choice to add.

Does PayHR offer integration with other HR software?

Sorry, the integration is not possible with any other HR software.

Contact

Please note that PayHR does not offer telephonic support. Our services are designed for self-service (DIY -Do it Yourself), and a help center is available on each page to assist you. For any inquiries, kindly reach out to us via email

Address

101, Tirupati Bhavan, Samarth Nagar, Badlapur, Maharashtra, 421503

Email Us

payhr.in@gmail.com