EPFO rules state that unemployed EPF account holders can avail non-refundable advance up to 75% of their balance after being unemployed for more than a month. If he continues to remain jobless for two months, he can then withdraw the entire PF corpus and close his EPF account

First, understand what is the purpose of the Provident Fund?

The primary focus of the Provident fund is to help employees to save a certain percentage of their salary every month. Employee and employer both contribute at 12% of wages into a provident fund account.This saving fund can be used under the following events;

•When an employee is temporarily not in service or

•The Employee no longer fit to work due unwell or

•After retirement earn pension or

•In the event of death, this amount will benefit dependent nominees or

•When any emergency fund is required during service for the following reasons, like medical, marriage, purchase or renovates the house, higher education

It has been noticed that during the Covid19 pandemic this corpus amount was a like life savior for employees when their employer was not in a situation to pay their salaries for 3 to 4 months or salary deferment was done. Always as a best practice, allocate some of your monthly savings for future needs. Provident Fund is one of the best saving options for salaried employees to go with.

On what all instance the EPF withdrawal online?

There are different scenarios when the accumulated EPF withdrawal online fully or partially. Let's look into some of these cases when the PF benefit can opt;

PF member is eligible for pension at the age of 58 years along with the EPF withdrawal of accumulated funds. If he quits a job between 50 and 57 years he can avail of an early but reduced pension. If he continues to work and contribute to EPF even after 58 years, he can avail pension from the age of 58

PF member in service can file a claim for non-refundable partial EPF withdrawal from his PF fund. This advance is provided for Medical urgency (self or family members), for Marriage (self, children or siblings), for Purchase or renovates the house, Education loan, Pandemic advance or in abnormal conditions

Upon the death of a PF member, the PF amount is paid to the nominee that was nominated at the time of the opening of the PF account. If there was no nominee assigned then the PF amount is paid to immediate members of the family. The application for the claiming fund should be submitted through the last employer

What is the importance of KYC's in PF member portal, is this mandatory for EPF withdrawal?

KYC or Know-Your-Customer is the process of verifying the identity of there customers. It is important for EPFO to get its Employees' Provident Fund (EPF) account with KYC compliant. If the EPF account is not KYC compliant, then PF members will not be able to avail of various EPF online services with the EPFO Member e-Sewa Portal. Some of these services include filing EPF online advance and EPF Withdrawal Online claim, transfer PF amount from the previous employer with a current employer, adding nominees. The EPFO allows members to complete the KYC process online, it uses digitally verified services like Aadhaar and PAN (Permanent Account Number) for e-KYC verification.

As per the latest PF guideline following below three KYC's is mandatory for availing online EPFO facilities;

Aadhaar Card

Aadhaar is primary KYC document proof for PF enrollment, without Aadhaar number employer won't able to generate or link a new UAN account of PF members. At the time of joining an organization, Aadhaar is the mandatory document to submit with the employer.

Pan Card

The government of India has made it mandatory to link PAN with various financial instruments. It also helps to save taxes on EPF withdrawals. Pan Card can be added as KYC either by employer or employee himself, which should be approved by the employer.

Bank Account

To get PF benefits directly credited to PF members saving bank account faster, seeding of saving bank account KYC is mandatory. Proper care should be taken while submitting bank account online with the UAN portal, the bank account should be valid and active.

How to withdraw Provident Fund amount?

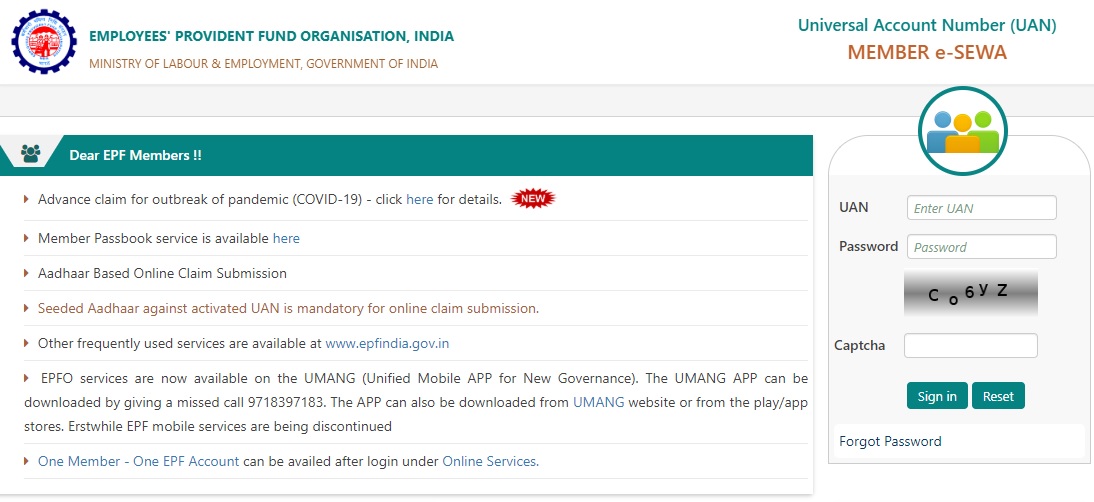

Step 1 : Login to UAN Member e-SEWA

The first step is to log in to the UAN member e-SEWA portal using member's credentials. The user id will be UAN account number and password what was initially set by the member while activation of UAN account.

Link for UAN account : https://www.unifiedportal-mem.epfindia.gov.in/memberinterface/

Useful Links

Step 2 : Check if KYC is added and approved

Once member login to his UAN account, the next step is to check if KYC is added and approved by employer.

1. If KYC is not added, then click on 'Manage', and goto 'KYC' and get its done.

2. IF KYC is added but not approved, then communicate with your Employer to get this approved using DSC signed.

3. If a member is withdrawing the full amount of PF(upon Resignation or Unemployment or after Retirement), then the exit date is compulsorily added by the last employer. If this is not done then approach the last Employer.

Step 3 : Go to member Claim Page

Once PF member clicks on 'CLAIM(Form-31,19,10C&10D)', then follow below steps;

1. Is the Exit date added correctly by the last employer, if there is any mismatch then approach the last Employer.

2. Enter the PF member's bank account number which was added and approved under KYC.

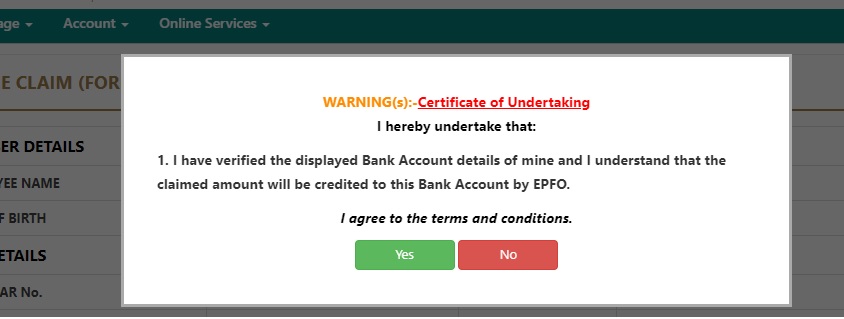

Step 4 : A Warning window will appear

1. Once the saving account number is entered and clicked on verify, a new window will appear. Here you will click on 'Yes' to proceed with the EPF withdrawal process.

2. The next option visible is to 'Proceed For Online Claim'. Here you have click on this.

Step 5 : Upload Form 15G and Copy of Bank account

1. For full EPF withdrawal of accumulated amount select option 'Only PF Withdrawal'.

2. If opting for PARTIAL EPF Withdrawal, then select the option "PF Advance(FORM-31)" and then select "Purpose for which advance is required".

3. Upload Form 15G, this document should be filled and uploaded, this is mandatory so excess tax won't be deducted from full claim amount withdrawal.

4. Upload copy of the cheque or bank passbook front page, this will help PF department to cross-verify PF members bank account number available under KYC.

Step 6 : Generate Aadhar OTP

1. Once the required mandatory details are filled, the next step is to click on "Get Aadhar OPT".

2. The Aadhar OTP will be sent to the mobile number which is registered with PF members Aadhar while enrollment.

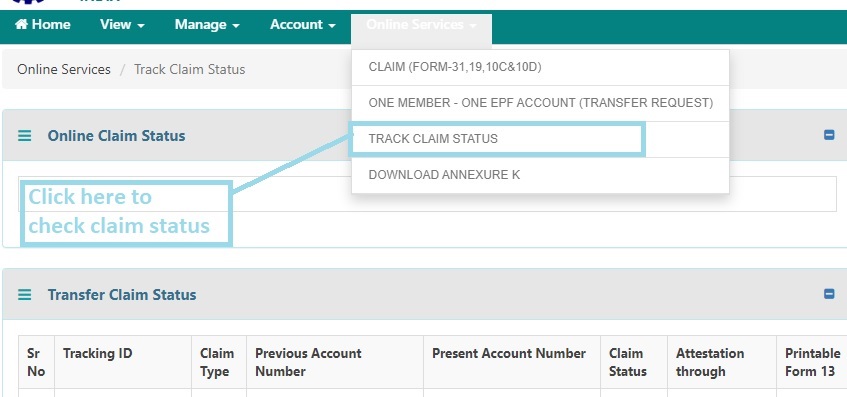

Step 7 : Track EPF withdrawal or Advance status

1. Go to Online Services --> Track claim Status. Generally it may take between 10 to 15 days for claim to be processed.

2. Once your claim status shows as "Processed", the PF money will be credited online to your bank account.

Step 8 : Income Tax deducted on EPF Withdrawals in certain cases ?

EPF withdrawal becomes taxable, when:

EPF withdrawn before 5 years of service, but the amount is more than Rs.50,000/-. In this case, TDS will be deducted @10%.

EPF withdrawal is tax free, when:

EPF withdrawal is made after 5 years of continuous services.

EPF is transferred to another account due to job change.

When PF member lost job (before 5 years of service) due to Illness, Company closure, Unemployement.

EPF withdrawn before 5 years of service, but the amount is less than Rs.50,000/-.